Advantages and Disadvantages of Mergers and Acquisitions

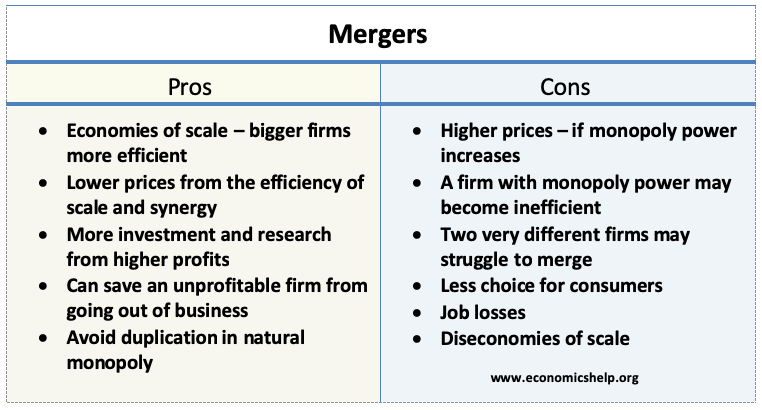

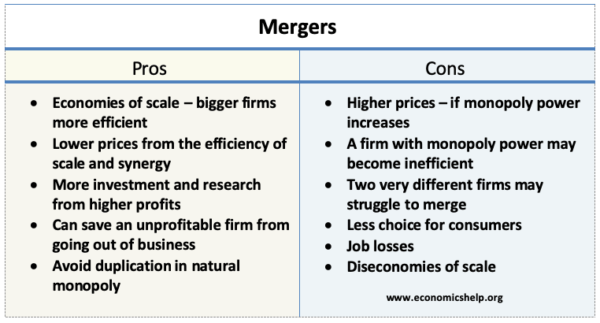

The advantages and disadvantages of an acquisition strategy suggest that it can be a way to grow markets improve revenues and increase consumer confidence. The disadvantages of mergers are as follows.

Mergers And Acquisitions 2 0 Youtube

Purple bubba strain effects.

. Advantages of a Merger. A new large business or a. A company needs to understand the process and the resulting.

Advantages of Mergers and Acquisitions. That is because of the factors. The Cons of Mergers and Acquisitions.

Substantial Increase in Prices A merger reduces competition and thus can give the acquiring company the monopoly power in the. Advantages of Mergers and Acquisitions. Although the terms merger and.

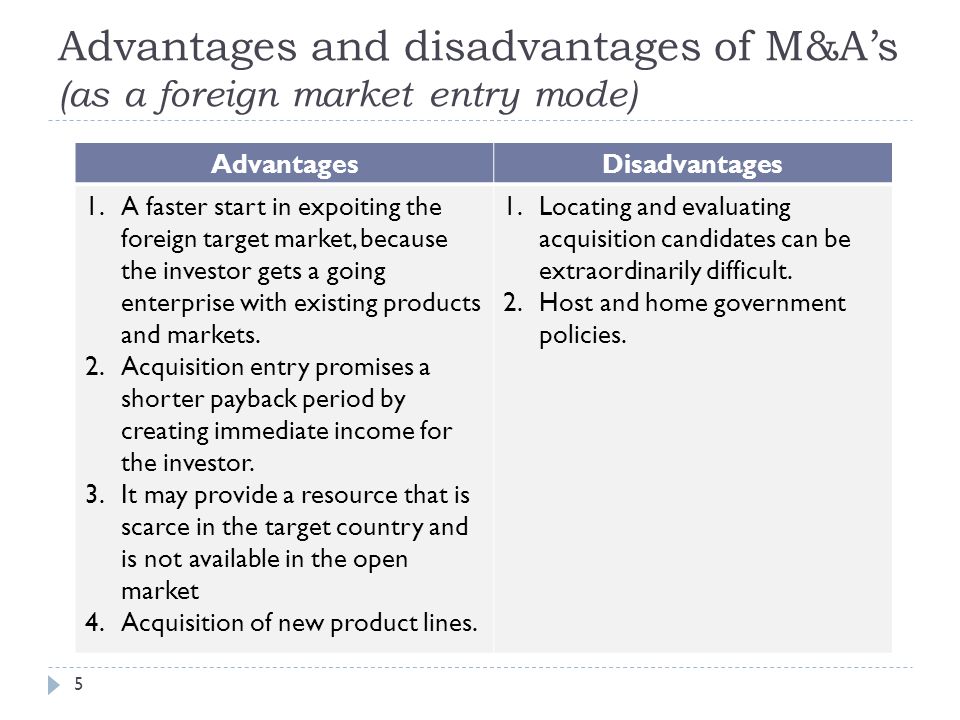

Advantages and Disadvantages of Mergers and Acquisition MA The advantage and disadvantages of merger and acquisition are depending of the new companies short term and. This is because the acquiring firm usually has to borrow. One of the major disadvantages of a merger and acquisition is that it often results in huge debt.

Some advantages of mergers and acquisitions are that it can help an organization expand its products and offerings and services it can provide the opportunity for firms to attain the three. However there may be risks associated with merger and acquisition related to lack of finance and time. Advantages and Disadvantages of Merges and Acquisitions.

The following are a few of the advantages of mergers and acquisitions. Acquisitions and Mergers sounds like it is a never ending story the markets are global and the competition is already impossible. The advantages and disadvantages of mergers and acquisitions are depending of the new companies short term and long term strategies and efforts.

Burns 2011 This essay will discuss more deeply the advantages and. Mergers and Acquisitions can be described as a step taken by any two organizations to make a more valuable company rather than two separate companies. An in-depth introduction to how EAs can successfully support the post-merger phase of MAs.

Financial advantages might instigate mergers and corporations will fully build use of tax- shields increase monetary leverage and utilize alternative tax benefits Hayn 1989. Acquisitions and Mergers sounds like it is a never ending story the markets are global and the competition is. Cons of Mergers and Acquisitions.

Lots of research have already found that. Communication and coordination between employees can be. The MA process invariably consolidates positions within the.

A merger in a new company all the previous companies disappear and a new company is created and different from the previous ones. It creates distress within the employee base of each organization. The mergers can be of two types.

Ad Everything about what is a Post-Merger Integration possible challenges and much more. The following are the advantages of mergers and acquisitions. When companies merge the new company gains a larger market share and gets ahead in the competition.

Advantages And Disadvantages Of Merger And Acquisitions Youtube

Pros And Cons Of Mergers Economics Help

Chapter 9 Strategic Aspects Of Acquisitions

Mergers And Acquisitions Ppt Video Online Download

Comments

Post a Comment